‘Halftime’ Report Shows Retail Growth in Central Virginia

As a part of its mission to inform the public of business activity, the Charlottesville Regional Chamber of Commerce today released data showing continued retail sales growth in the region.

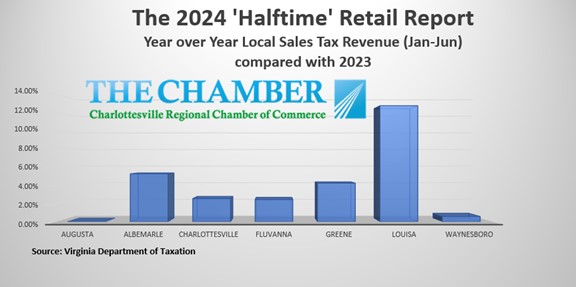

The 2024 ‘Halftime’ Retail Report, which compares data from January to June 2024 with the same period in 2023, indicates 2024 retail and internet sales growth in all seven Central Virginia localities tracked by the Charlottesville Regional Chamber of Commerce.

In total, the localities studied collected $1,317,455 (3.98%) more in local retail sales tax in the first half of 2024 compared to the same period in 2023.

Louisa County saw the largest percentage increase at 12.71%. Albemarle County showed a robust 5.25% increase, while Charlottesville, Fluvanna, Greene, and Waynesboro all showed growth over 2023.

Chamber Chairperson Sasha Tripp said, “Enterprise owners will see the “2024 ‘Halftime’ Retail Report” as the glass is half full. While June sales dipped in most of the localities, the overall salles remain positive for the first half of 2024 across the Chamber footprint.”

The Chamber encourages community members to “shop local” this holiday season. For more information on local shopping destinations, visit cvillechamber.com/shoplocal.

The 2024 ‘Halftime’ Retail Report data is based on the Virginia Department of Taxation’s Local Option Sales Tax Data. According to the University of Virginia’s Weldon Cooper Center for Public Service’s Center for Economic Policy Studies:

“Any city and county may levy a general retail sales tax at the rate of one percent to provide revenue for the locality’s general fund. All local sales tax moneys collected by the localities are paid into a state treasury special fund. The State collects and distributes this Local Option one percent Sales and Use Tax, as provided under the Code of Virginia §58.1-605 and §58.1-606. Actual distributions are made monthly to every county and city based on the locality in which the tax was collected. The amounts are recorded in the Local Option Sales Tax report.”

In general, all sales, leases, and rentals of tangible personal property in or for use in Virginia, as well as accommodations and certain taxable services, are subject to Virginia sales and use tax, unless an exemption or exception is established. Fuel and automobile sales are not included in the local sales tax option. The local “option” is a bit of a misnomer as the State has mandated its collection at a minimum of 1% for all localities in the state (Hampton Roads, Northern Virginia, and Historic Triangle have additional sales tax).