Retail Numbers Inspire Cautious Optimism in First Quarter of 2024

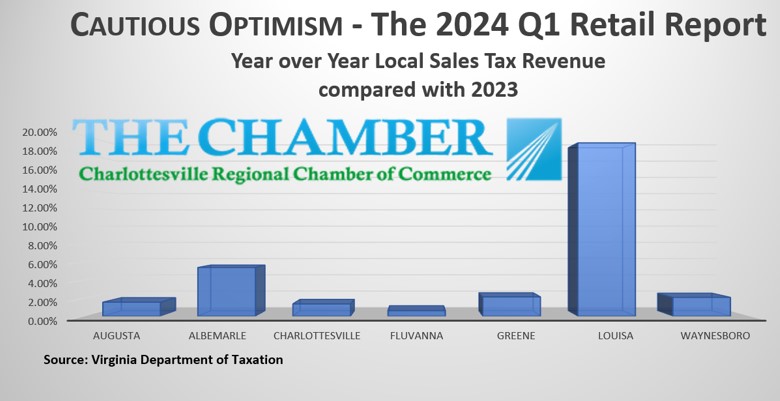

The Charlottesville Regional Chamber of Commerce has announced its analysis of 2024 Q1 data indicates retail and internet sales growth in all seven Central Virginia localities tracked by the Chamber.

Charlottesville, Albemarle County, Augusta County, Fluvanna County, Greene County and Waynesboro each collected more retail sales tax in the first quarter of 2024 compared to the same period in 2023.

In total, the localities studied collected over $730,000 (4.63%) more in retail sales tax over Q1 last year. Louisa County saw the largest percentage increase (19.23%) and Albemarle showed a robust increase (5.41%), while Charlottesville, Augusta, Fluvanna, Greene, and Waynesboro showed slight growth.

Chamber Board Chair Sasha Tripp stated, “Enterprise owners will find reasons for cautious optimism in the details of our 2024 Q1 retail analysis. While the size of expansion varies across our localities, I am happy to report retail sales are up across The Chamber footprint.”

The Chamber’s analysis is based on the Virginia Department of Taxation’s Local Option Sales Tax Data. According to the University of Virginia’s Weldon Cooper Center for Public Service’s Center for Economic Policy Studies:

“Any city and county may levy a general retail sales tax at the rate of one percent to provide revenue for the locality’s general fund. All local sales tax moneys collected by the localities are paid into a state treasury special fund. The State collects and distributes this Local Option one percent Sales and Use Tax, as provided under the Code of Virginia §58.1-605 and §58.1-606. Actual distributions are made monthly to every county and city based on the locality in which the tax was collected. The amounts are recorded in the Local Option Sales Tax report.”

In general, all sales, leases, and rentals of tangible personal property in or for use in Virginia, as well as accommodations and certain taxable services, are subject to Virginia sales and use tax, unless an exemption or exception is established. Fuel and automobile sales are not included in the local sales tax option. The local “option” is a bit of a misnomer as the State has mandated its collection at a minimum of 1% for all localities in the state (Hampton Roads, Northern Virginia, and Historic Triangle have additional sales tax).